When you’re buried in bills, any offer of help sounds appealing. Which is exactly what scammers are counting on. If you’re exploring debt relief vs debt consolidation, it’s important to know the difference and how scammers prey on people desperate for a way out.

Debt consolidation can be a powerful tool when used correctly. Debt relief can also help. However, both industries are magnets for shady operators. In 2025, scam artists are getting sneakier, and the wrong move could leave you even deeper in debt.

Being broke is expensive. There’s no need to make it worse. Here’s how to protect yourself, spot the red flags, and choose safe options that actually help you move forward.

Debt Relief Vs Debt Consolidation: What’s the Difference?

Before diving into scams, let’s clear up the difference between relief and consolidation.

Want more?

Join us for updates and new information.

Because Googling “how to fix my finances” will only take you so far.

- Debt Consolidation usually means combining multiple debts into one new loan with one monthly payment. The goal is often to lower your interest rate or simplify your payments.

- Debt Relief refers to negotiating directly with creditors to reduce what you owe, sometimes involving partial forgiveness or a settlement. The creditor generally does the negotiating.

Both options can work, depending on your situation. But each has real risks, especially when scammers get involved.

How Debt Consolidation and Debt Relief Scams Work

Scammers take advantage of confusion between debt relief and debt consolidation, or just your situation in general. Here’s what to watch out for:

- Fake loan approvals: They promise you a loan or a settlement without even checking your credit.

- Upfront fees: They demand payment before helping — a sure sign something’s off.

- Pressure tactics: “Act now!” offers, pretending there’s a deadline to scare you into fast decisions.

- Fake credentials: Using names that sound official, like “Federal Debt Settlement Agency.”

- Phishing for personal information: Asking for your Social Security number or bank info before offering real help.

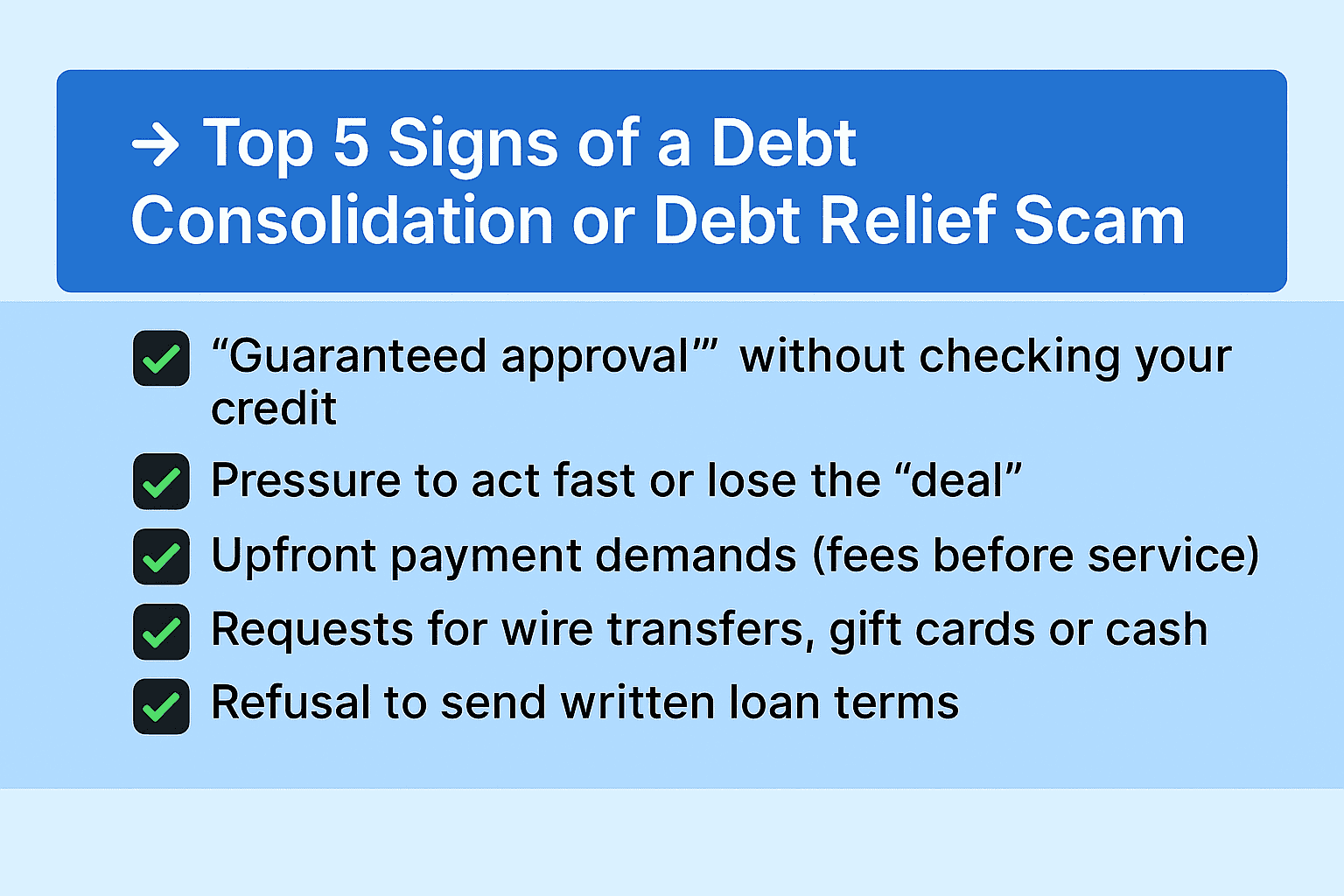

Red Flags That Scream ‘SCAM’

If you spot any of these, be extra cautious:

- No physical address or a fake-looking online presence

- Only communicating through email, social media, or messaging apps

- Pushes wire transfers, gift cards, or prepaid debit cards as payment

- Promises guaranteed approvals, no matter your credit

- Refuses to provide loan terms, payment plans, or settlements in writing

Scammers want fast decisions and no paper trail. Don’t give them either.

How to Protect Yourself

Stay safe by being smart:

As long as you’re here, why not start budgeting the right way? Grab the workbook that keeps your wallet fat and your stress low.

$12.95

- Research the company

Check them out on the Better Business Bureau (BBB), Consumer Financial Protection Bureau (CFPB), and Trustpilot. - Avoid upfront fees

Legitimate services explain their fees clearly and don’t charge you before delivering results. - Guard your info

Only share sensitive information once you’ve verified the company’s legitimacy. - Demand details in writing

Don’t fall for promises made only over the phone. - Listen to your gut

If something feels off, you’re probably right.

Links

Safer Alternatives for Managing Debt

If you want real help with your debt, here are legitimate options:

- Negotiate with creditors yourself

Ask about hardship programs, lower interest rates, or flexible payment plans. - Work with nonprofit credit counselors

Agencies like those certified by the NFCC can help create a personalized plan. - Use trusted lenders

Banks, credit unions, and reputable online lenders offer real debt consolidation loans. - DIY your debt payoff

Try the debt snowball or avalanche method — no new loans needed, just a smart strategy. Use the resources on our calculators page and our tools and budgets page.

Now What?

Understanding debt relief vs debt consolidation is the first step to protecting your financial future. Scammers count on confusion, but armed with knowledge, you can stay a step ahead.

Take your time. Do your homework. And most importantly, trust your instincts.

Leave a Reply