Here’s why budgeting matters.

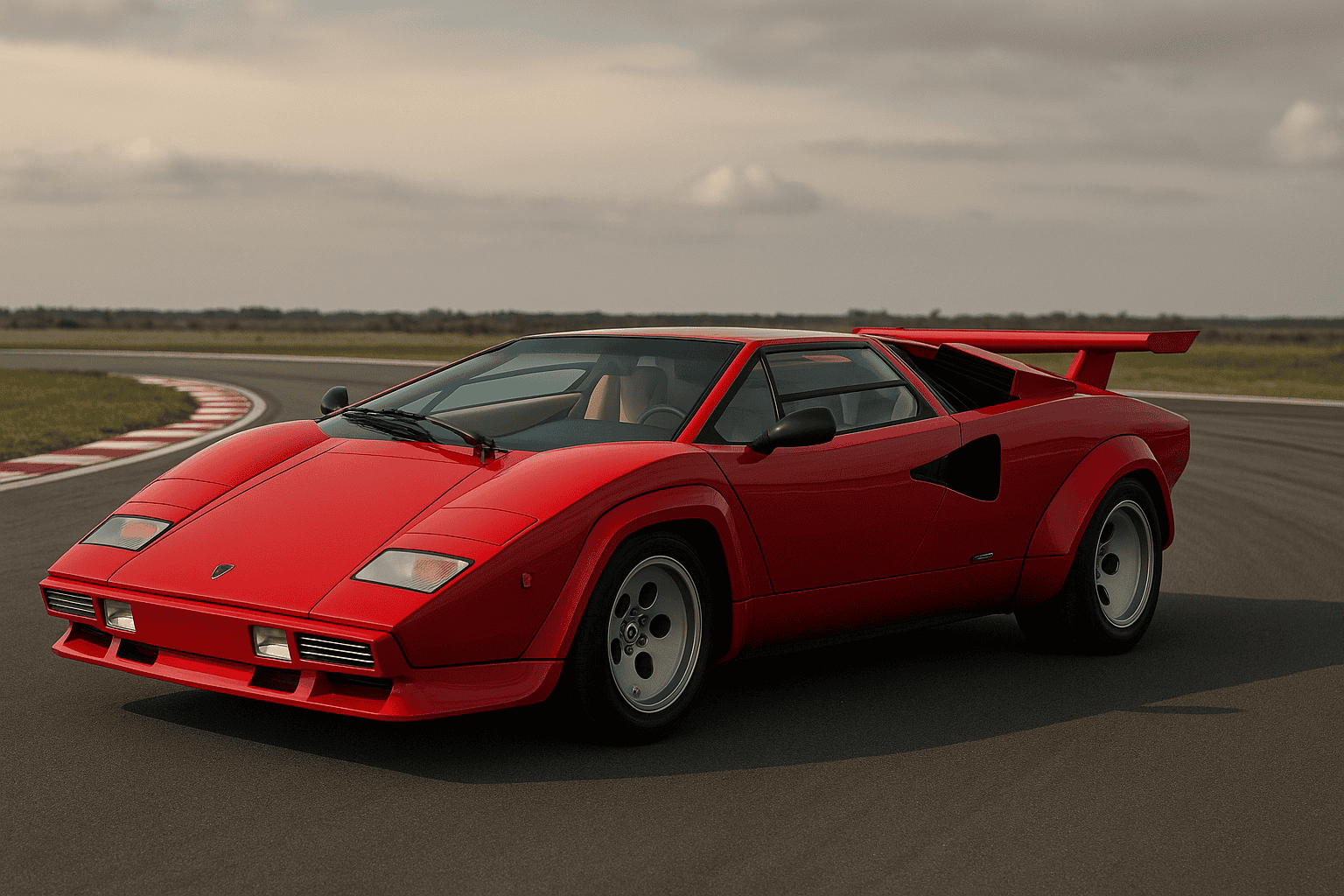

When I was a kid, I had a poster of a Lamborghini on my bedroom wall. Cherry red. Sleek lines. The kind of car that looked like it could outrun your problems. I didn’t just want it—I planned to have one by the time I was 35. That was the dream.

Well, 35 came and went.

No Lamborghini.

What happened?

Want more?

Join us for updates and new information.

Because Googling “how to fix my finances” will only take you so far.

Dreams Need More Than Posters

It wasn’t that I stopped wanting cool things. Or that I stopped dreaming. But the truth is, life got in the way—and I wasn’t ready for it. There was no financial plan. No budget. No roadmap. Just vibes, credit card bills, and a lot of, “I’ll figure it out later.”

Spoiler alert: later never comes on its own.

I never sat down in my 20s or early 30s to ask, “What would it actually take to get there?” I just assumed success would happen. Money would flow in. The Lambo would follow.

Your Dreams Might Look Different Now—and That’s Okay

Chances are, you’re not chasing a Lamborghini anymore either. Maybe now, it’s:

- Paying off your credit cards

- Having a safety net in your savings account

- Not feeling anxious every time rent or mortgage is due

- Taking a family trip without guilt or debt

- Retiring without relying on your kids

- That’s the thing about dreams—they grow up with us. But they still need a plan.

So… What Are You Waiting For?

Budgeting isn’t about being boring or saying “no” to everything. It’s about being able to say “yes” to the right things—on your terms. It’s about control. And, it’s about peace of mind. And it’s about knowing that you don’t have to be rich to feel secure.

In fact, you can feel a whole lot better about your money situation in just a few months of consistent budgeting. That’s why budgeting matters—it’s the first step to building financial confidence, even if you’re starting from scratch. A simple strategy like the 50/30/20 rule can help you organize your income in a way that actually works in real life—no spreadsheets required.

Still not convinced? You might want to read about the real cost of being broke. It’s not just about missed opportunities—it’s about paying more for everything when you’re living on the edge.

And if you’re thinking long-term, budgeting is also a key part of living sustainably. Not just environmentally—but financially, too. A budget helps you live within your means and align your money with your values.

As long as you’re here, why not start budgeting the right way? Grab the workbook that keeps your wallet fat and your stress low.

$12.95

Here’s the Truth

- You don’t need a six-figure salary to build a strong financial foundation.

- You don’t need perfect math skills to make a budget that works.

- And you definitely don’t need a Lamborghini to feel successful.

You just need to decide that your future is worth the effort. Because it is.

Related Article: How to Stop Living Paycheck to Paycheck and Save Money

Take the First Step

Open a spreadsheet. Grab a notebook. Use a budgeting app. Or better yet, download the free tools right here on Matt’s Dad Says.

Figure out what’s coming in, what’s going out, and what you want your money to do for you.

Dreams change—but peace of mind is always in style.

Leave a Reply